Currently, it is evident that the larger the scale of an industry, the greater the number of processes in production, and consequently, the more links there are in the logistical path of a product.

Today, we know that good logistical and production planning, combined with efficient channels and integrated strategies across the supply chain, are essential to ensure the right product, in the right quantity, in retail for more sales and margins.

However, ensuring the right product, with the right assortment, in the right quantity on retail shelves is a challenging task that requires appropriate tools.

Want to know how to ensure adequate inventory across all links in the supply chain? Follow us in this content, which will provide the best ways to manage retail more effectively for the industry and its partners.

Why is inventory management across all links, including retail, important?

As production chain processes become more modernized, it becomes clear that individuality is no longer an option for remaining competitive in the market.

The number of logistical channels and intermediaries is proportional to the volume of information that needs to be organized for a company’s decision-making process.

Therefore, the industry needs to establish partnerships and build channels that enable joint strategic planning based on integration between processes.

One step in this efficient integration process involves effective inventory and sell-out management by the industry. But the question is: how can this be done in the best way?

We know that the relationship between industry and retail does not always occur within the supply chain. This happens because some industries sell directly to the end consumer, while others only sell to distributors.

However, when this relationship does occur, it can be conducted in various ways and with a greater or lesser number of agents.

These agents can be part of the logistical and sales processes, or processes adopted by the industry itself in partnership with its channels.

For example, a food industry typically serves a large number of retailers. This requires planning that is adapted to the size of these retailers, demand forecasting, and distribution channels.

But at which stages can an industry contribute to ensuring that retail performance aligns with what was previously planned and projected?

This varies depending on the supply chains each industry has built, but monitoring product batches and pricing, customer share numbers, and direct sell-out information at points of sale are just a few of the ways the industry can manage efficiently.

For this reason, good retail inventory management is extremely important.

Thus, it is crucial to be aware of a number of obstacles that can make retail inventory management strategies more challenging or inaccurate.

The Main Obstacles to Efficient Retail Inventory Management

We have seen that the industry has good options for managing retail inventory and that the more information it has about the processes, the better its strategic process will be.

However, it is important to remember that planning integrations also involves a number of obstacles, ranging from inflexible partners to inaccurate data.

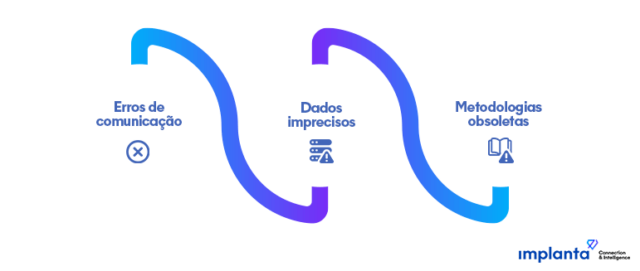

Some of the main obstacles to effective retail management include:

Communication Errors

The more agents involved in the sales cycle of a product, the greater the risk of communication errors and resulting harm to the industry.

Communication errors are common, especially when there is limited information exchange and inefficiency in communication between the channels and the industry.

Lack of integration is often caused by reluctance to share data or an individualistic attitude from one of the partners.

These issues impair communication and can lead to flawed production and logistics planning, potentially resulting in stockouts or excess production.

After all, both stockouts and excess production lead to resource loss for the industry and negatively impact everyone in the supply chain.

Inaccurate Data

Unlike the context of communication errors, here the issue is that data is indeed shared. However, the main concern in these cases is the quality and accuracy of the data.

We know that the lifecycle of a product manufactured by an industry involves several stages, including production, storage, transportation, and sales (both sell-in and sell-out).

Each of these stages generates a large volume of data that, when combined and interpreted, provides the necessary information for the industry to make decisions, create strategies, and plan production.

Therefore, when the data from these stages is inaccurate, the entire decision-making process affected by this data is also compromised.

Thus, just as important as obtaining data on sales, performance, stock position, and sell-out is ensuring the quality and, most importantly, the accuracy of this data in the planning process.

Obsolete Methodologies

The modernization of processes that accompanies Industry 4.0 demands that all organizations in the supply chain adopt processes that streamline and optimize decision-making.

This includes building supply chains based on new technologies that automate processes which previously required bureaucracy and were prone to various errors.

Advancements such as data intelligence have enabled industries to optimize their processes and make decisions more quickly and accurately.

The paradigm shift brought by Industry 4.0 also ensures that information provided by these new technologies supports methodologies with a more strategic process and data with much greater accuracy, all in real-time and from anywhere.

Therefore, we see that poor retail management is often due to factors related to the lack of integration between channels and the industry.

Limited information exchange, communication errors, fragmented and exclusionary planning—all contribute to chains destined for errors. But ultimately, what practices make retail inventory management truly efficient and intelligent?

Intelligent Use of Collected Retail Data

Building integration practices and utilizing retail data effectively is part of a comprehensive diagnosis of the processes involved in the product lifecycle. These processes directly impact how products interact with the end consumer through retail channels.

What are the sales numbers for this product? What is the overall performance of my portfolio with these retailers? What pricing is being adopted at the points of sale? Is the desired product assortment available at these points of sale?

These are some of the questions that intelligent retail management needs to answer.

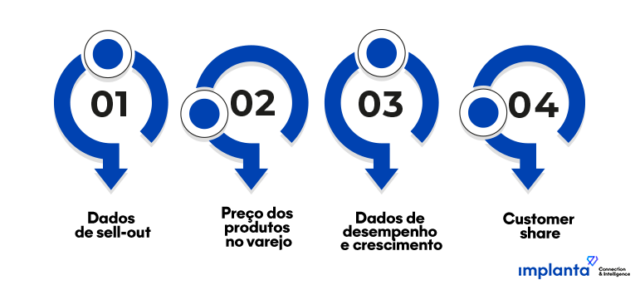

For this reason, adopt tools that provide precise and real-time insights so you can make the best decisions and improve your strategy. Effective retail management practices include:

Sell-Out Data

Obtain sales data directly from the points of sale (POS), which will enable you to better plan your production. Additionally, this information will help you identify which products in your catalog are generating positive sales results and which need more resource allocation.

Retail Product Pricing

Knowing the price of your products at the retail level will give you a better understanding of your product's competitiveness from the consumer's pricing perspective.

Performance and Growth Data

Understanding the performance of your products through reports will help you identify which products have long-term growth potential.

Furthermore, ranking these products will provide a clearer picture of their growth potential, leading to better production planning.

Customer share

More than just capturing market share, it is also crucial to win over customers with increasingly personalized strategies. Therefore, obtaining customer share data will help you better profile your consumers.

Want to Plan with Data Collected Directly from Retail? Rely on Implanta!

Building intelligent management requires precise and timely data.

That’s why Implanta's Retail Visibility solution provides a range of data with 99.8% accuracy to ensure your decision-making is precise and your plans are well-structured.

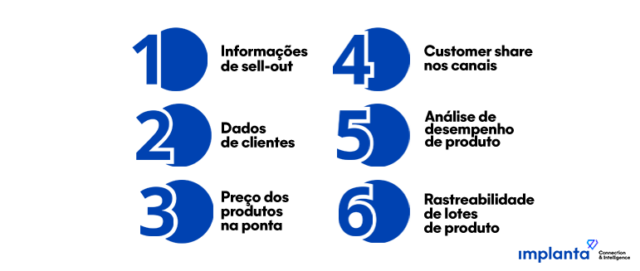

Implanta's solutions include data that allows for monitoring products in the retail channel, such as:

- Sell-out information;

- Customer data;

- Retail product pricing;

- Customer share across channels;

- Product performance analysis;

- Product batch traceability.

Want to implement intelligent retail management? Talk to one of our specialists!